Life can be wonderful. But it can also get complicated when unexpected things happen. Protecting your loan payments against death, disability or involuntary unemployment could help protect your finances.

This protection could cancel your loan balance or payments up to the contract maximums. Protect your loan payments today so you can worry a little less about tomorrow.

Purchasing protection is voluntary and won't affect your loan approval. It's simple to apply. Ask your loan officer about eligibility, conditions or exclusions.1

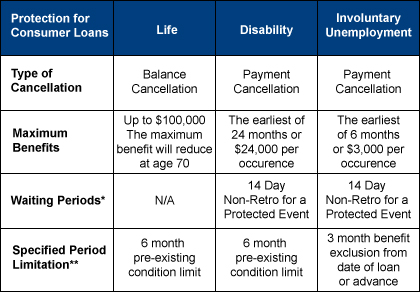

The table below is intended to provide a general description of the optional protection program for consumer loans.

GAP Plus

Will you owe more on your vehicle loan than your vehicle is worth?

Guaranteed Asset Protection Plus (GAP Plus) is like an airbag for your vehicle loan.

Guaranteed Asset Protection (GAP) Plus can help fill the gap between what your vehicle insurance will pay and what you owe on your loan, to cushion you against sudden out of pocket expenses if your vehicle is totaled or stolen. GAP Plus may cancel part of your next loan with KCT, when you purchase a replacement vehicle. GAP Plus can help lighten the financial burden for you and the people you care about. Get GAP Plus today so you can worry a little less about tomorrow.

The second you drive your new vehicle off the lot it drops in value. Up to 22% in one year. This creates a gap in coverage. Another benefit is that GAP Plus will pay $1,000 towards the principal balance of your next auto loan with KCT in the event of a claim*. This offer is only available to those who have a current auto loan with KCT.

Talk to your loan officer to purchase GAP Plus today.

® Guaranteed Asset Protection (GAP) is optional and will not affect your application for credit or the terms of any credit agreement you have with KCT Credit Union. Certain eligibility requirements, conditions and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid. Prices of the refundable and non-refundable products are likely to differ. If you choose a refundable product, you may cancel at any time during the loan and receive a refund of the unearned fee.

*The first $1,000 is cancelled under your replacement vehicle financial agreement when vehicle is financed by your credit union within 120 days after member's primary insurance company issues a settlement check.

Mechanical Repair Coverage

The miles can add up but the repair costs don't have to.

Member's Choice® Mechanical Repair Coverage can help deflect some risk of costly repairs keeping your vehicle running extra miles and extra years. With different coverage levels and deductibles to choose, there's a plan to fit your family's budget.

Whether you depend on your vehicle for work or getting your family to school and activities, you need transportation that's safe and reliable. The older your vehicle, the more it takes to keep it in good working order. Not making small repairs can lead to even more expensive repairs and other repairs can be dangerous.

Benefits of the program*:

-

Good at any authorized repair facility in the U.S. or Canada

-

Rental reimbursement: up to $35 per day for 5 days (or 10 days for a verified parts delay) from day one.

-

24-hour emergency roadside assistance: up to $100 per occurrence. Includes towing, battery jumpstart, fluid delivery, flat tire assistance and lock-out service.

-

Travel expense reimbursement: up to $200 for 1-5 days for lodging, food and rental expenses when a covered breakdown occurs more than 100 miles from home.

-

Transferable: if you sell your vehicle privately, the coverage can be transferred for a fee, adding resale value and appeal.

-

Cancelable: receive a full refund within the first 60 days or a pro-rated refund thereafter less an administrative fee.

-

No out of pocket expense at time of mechanical repair: (except for any deductible and any repairs not covered by the policy)–the covered repair is paid directly to the authorized repair facility by the plan.

-

Limit repair costs to you deductible, you choose your deductible - $0, $100, $250 or $500.

*Program details may vary by state. Ask your loan officer for details or receive a quote by calling 847-741-3344.