Our Teen Checking Account is designed to help teens establish healthy saving and spending habits by offering a FREE, everyday checking account, access to financial literacy resources and tools. Available for kids ages 13-17. Minimum opening deposit of $25, no annual fees, no service fees, no minimum balance requirements.

Benefits of a Teen Checking Account:

Free KCT Debit Card

Gives you the chance to learn the basics of debit card use when shopping around town, online, or anywhere Visa is accepted.

Enhanced Fraud Protection

Through Visa's Zero Liability Policy*

Access to KCT Online and KCT Mobile banking

Utilize budgeting and tracking tools, with the added access of financial literacy resources

Establish healthy savings and spending habits

With access to KCT Online and Mobile, you can keep track of your savings and spending right from your phone.

Practice Simple Habits of Saving:

Financial Activity Worksheets

|

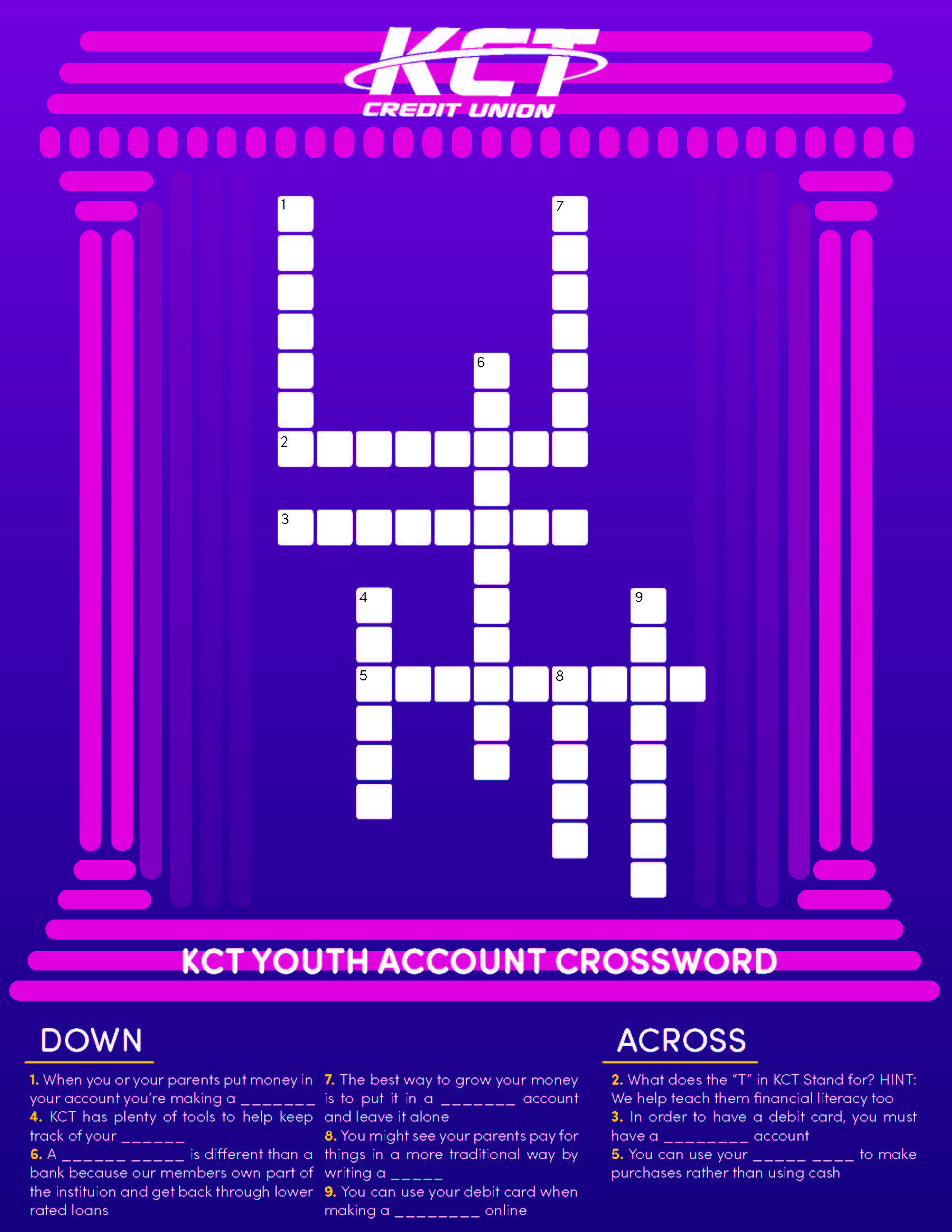

Financial Crossword Puzzle

|

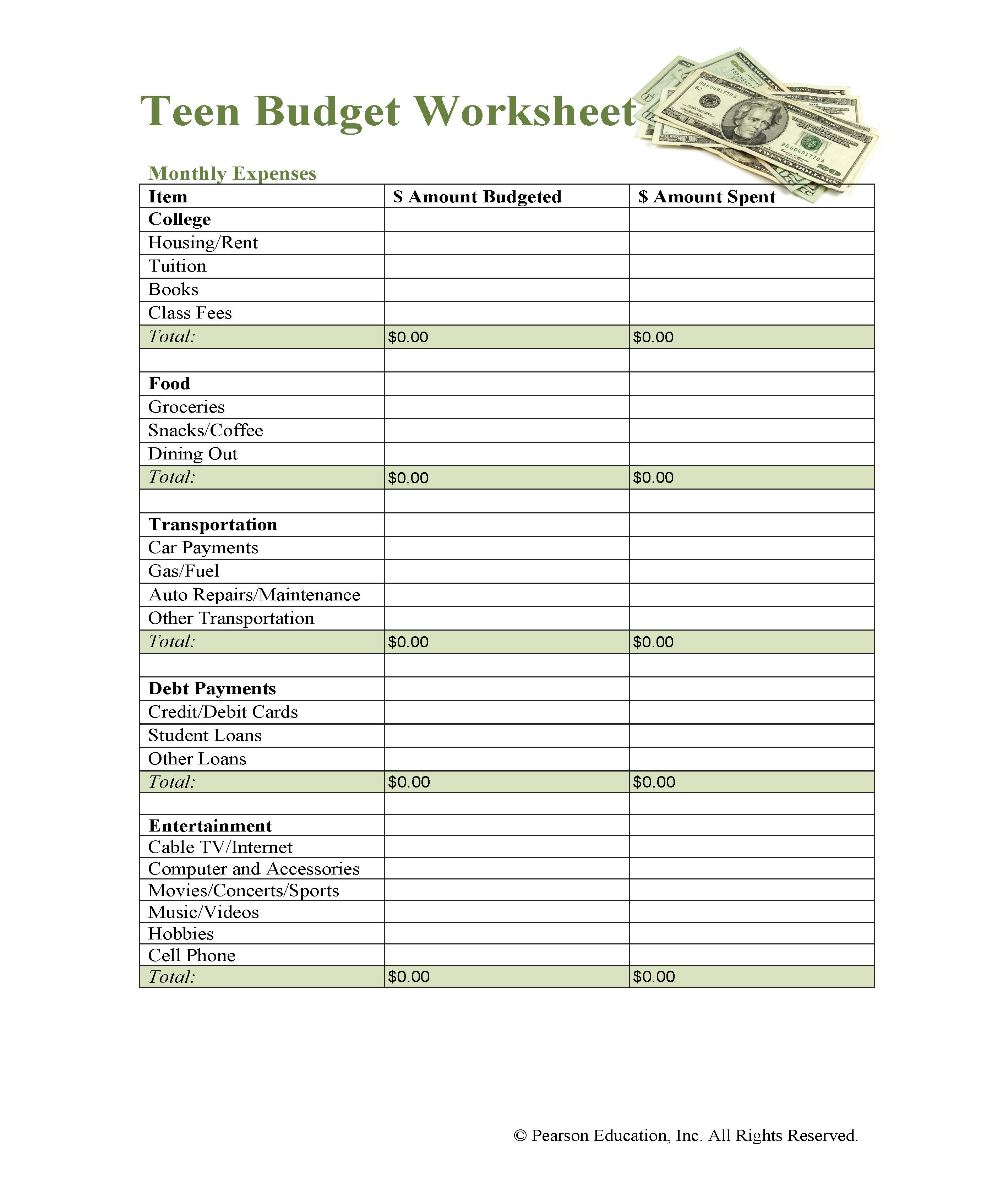

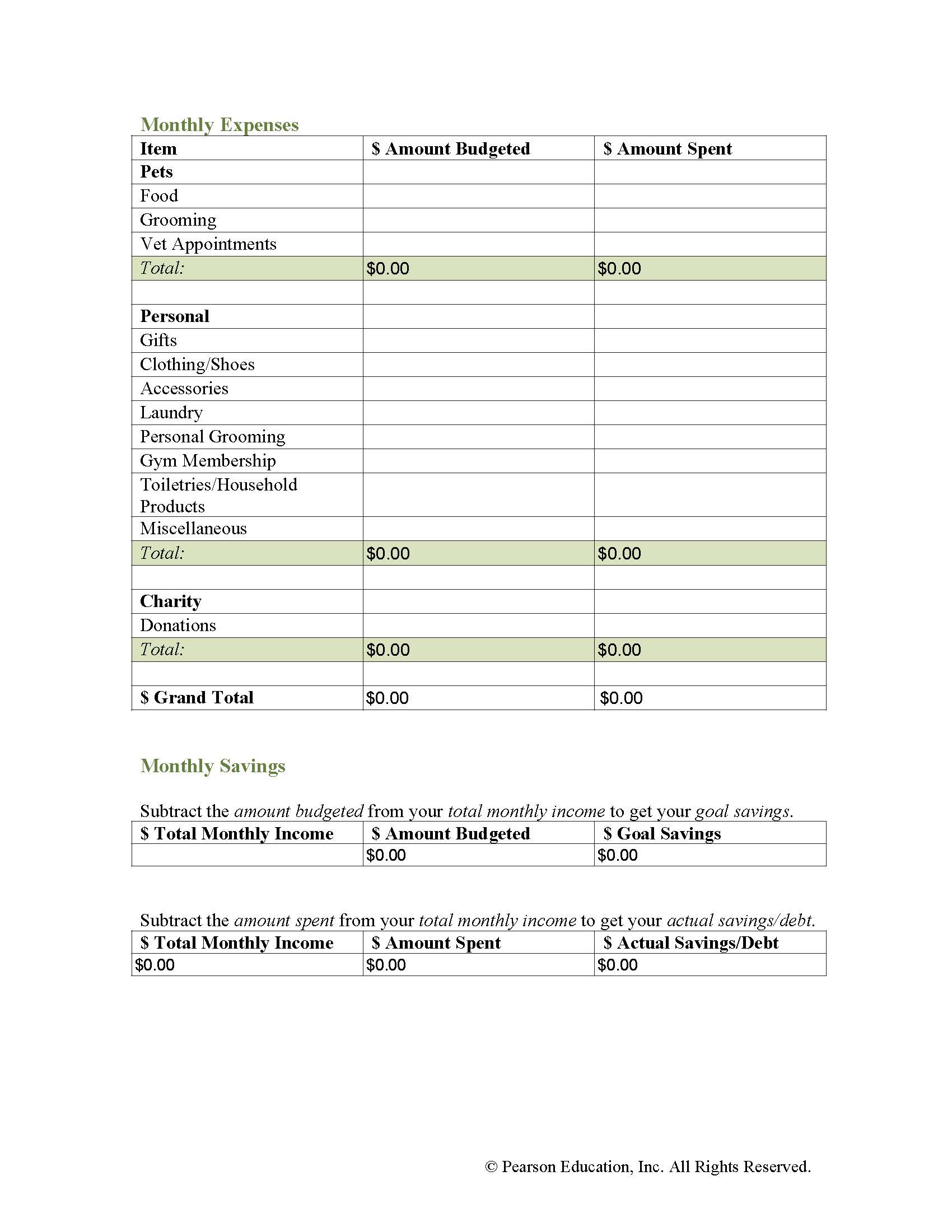

Budget Worksheets

|

Financial Football: Are you up for the challenge?

Visa and the NFL have teamed up to create Financial Football - a fast-paced, interactive game that engages children in football while teaching them about financial concepts and money management skills. The game is available to play for free through iOS and Android apps and online. Select the game screen below to play!

Financial Literacy: Points to Ponder

Here you will find financial tips and advise. Curious about a topic that hasn't been posted, reach out and let us know at marketing@kctcu.org

Open a Teen Checking Account at your nearest KCT branch today!

1Teen Checking is designed to help teens establish healthy savings and spending habits by opting out of Courtesy Pay, Overdraft Protection and Regulation E. Must be 13-17 years old to qualify for the Teen Checking Account. Membership and other qualifications apply. Parent or Legal Guardian must be named as joint owner (Teen as primary). Required minimum opening deposit: $25.00.

*Visa’s Zero Liability Policy covers U.S.-issued cards and does not apply to certain commercial card transactions or any transactions not processed by Visa. Individual replacement fund amounts are provided on a provisional basis and may be withheld, delayed, limited, or rescinded by KCT Credit Union based on factors such as gross negligence or fraud, delay in reporting unauthorized use.You must notify KCT immediately of any unauthorized use. Transaction must be posted to your account before replacement funds may be issued. For specific restrictions, limitations and other details, please consult your issuer.